Results of the CBES Biennial Exploratory Scenario and the impact on lenders

27 May 2022

Key Points

-

The impacts of climate change risk are expected to create a drag on the profitability of the UK financial sector. These risks should be manageable for UK lenders; however inaction or delay will prove costly.

-

For mortgage portfolios, regionally concentrated losses from flooding will be substantial without a transition to net-zero, due to properties becoming uninsurable.

-

Under a transition scenario, mortgage losses will be due to a small proportion (<1%) of properties becoming unmarketable as these properties cannot be upgraded to achieve minimum energy efficiency.

-

An early transition to net-zero will have the least impact on mortgages. A late transition, however, will see substantial losses as the sudden shift away from a high-carbon economy leads to unemployment and a fall in house prices.

-

For corporate lending portfolios, either transition scenario will drive high rates of impairment on exposures to high-carbon sectors.

Introduction

The Bank of England has released the results of the 2021 CBES exercise, the first stress test exercise in the UK to test the resilience of the financial sector to the threats and challenges posed by climate change. Participating banks and insurers were asked to model the impacts and losses that they could incur under three different scenarios of global response to a changing climate. Under two of the scenarios, carbon emissions were reduced to net-zero and global temperature increases were limited to 1.5C by the end of the century. The Early Action scenario forecast a smooth and gradual transition, however under the contrasting Late Action scenario, the transition is sudden, causing a ten-year downturn in productivity. A third scenario (No Additional Action) asked participants to model a world where net-zero is not achieved, and with no or limited attempts to reduce carbon emissions, global temperatures increase by 3.3C. Under this scenario, the UK would face increased flooding, coastal erosion and subsidence risks, with similar increases in physical threats across the world.

Retail Mortgages

The aggregated results of the CBES exercise across all of the banking participants showed that for mortgage lenders, the most substantial losses will come if no action is taken on climate change. Projections of increasing flood risk, combined with a reduction in insurance availability for the worst affected properties, produced losses 170% greater than the baseline (“counterfactual”) scenario, with losses concentrated in the regions at highest risk of flood. Significantly, these losses only capture the impact within the 30-year CBES horizon – under a No Additional Action scenario, losses would continue to accrue well into the future.

In contrast, the Early Action scenario produced only modest losses (40% above baseline), driven by the costs and additional credit risk of householders improving their home energy efficiency, and the reduction to land value of the least energy efficient properties. Late action on climate change substantially increased the losses to 160% of the baseline as the recession created by the sudden shift to a low-carbon economy led to rising unemployment and a drop in property value.

Corporate Exposures

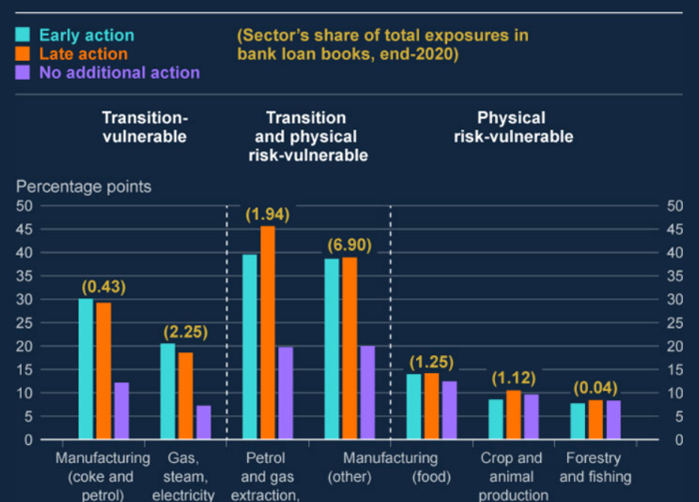

For corporate exposures, transitioning to a net-zero economy had the greatest impact on impairment rates, with little difference whether this occurred early or late. Not surprisingly, impacts are concentrated in the most energy intensive sectors, with fuel production, manufacturing, and energy production carrying substantially higher risk. Corporate exposures were not free from physical impacts however – in addition to fuel production and manufacturing, agriculture and forestry were identified as sectors where increases in impairment rates from physical risks would occur.

Challenges

The banking sector is still very much in the early stages of developing their climate risk appetite framework, with most CBES participants relying heavily on qualitative metrics. The CBES exercise emphasises how expanding and improving the modelling of climate risk would allow banks to develop a more nuanced approach to risk management, giving lenders the tools to assess the climate risk impact of lending, pricing and investment decisions. As the report notes, however, a key challenge will be around data and modelling capabilities. Few banks have the in-house expertise to model climate risk effectively, and assessing risk is complicated by unstandardized, incomplete, and out-of-date data on the physical and transition risks affecting the portfolio.

The intention behind the CBES exercise was not to set new capital requirements, however regulators both in the UK and Europe are currently investigating how to embed climate risk into the existing structures for IFRS9 provisioning and allocation of Pillar 1 capital. The recently released EBA discussion paper[1] and the PRA Climate Change Adaptation Report 2021[2] both discuss in some length the challenges involved given that the Pillar 1 framework was designed to deal with cyclical economic fluctuations rather than growing environmental impacts, e.g., estimating impacts over long time horizons, dealing with non-linear effects and tipping-points, and the issue of validation and appropriate conservatism. While neither regulator has stated that climate change credit risk will form part of capital requirements, both regulators are exploring mechanisms to address the risks that climate change will bring.

Finally, the CBES scenarios should not be seen as definitive forecasts of the future. As recent events have shown, global macroeconomic shocks can be stronger and more sudden than in the CBES projections, and tipping-points and non-linear effects caused by climate change could lead to much greater physical risk impacts than currently projected. A key conclusion of the report is that banks must do more to develop the modelling capability to assess and quantify a range of future outcomes.

4most

4most has been working with our clients in the banking industry to provide them the tools to assess and quantify their climate change credit risk, understand their financed emissions and to integrate climate risk into their risk appetite statements, origination strategies and disclosures. One of the core principles of 4most is that all solutions are developed in close collaboration with the client to ensure that the client has full confidence in taking ownership of the solution.

Our framework for modelling climate risk was awarded the prize for best presentation at the Edinburgh Credit Conference 2021 and we continue to be leaders in developing modelling approaches for climate credit risk and stress testing in general.

[1] “The role of environmental risks in the prudential framework – Discussion paper EBA/DP/2022/02” EBA 2 May 2022

[2] “Climate-related financial risk management and the role of capital requirements” PRA 28 October 2021

Interested in learning more?

Contact usInsights

UK Deposit Takers Supervision – 2026 Priorities: What banks and building societies need to know about the PRA’s latest Dear CEO letter

21 Jan 26 | Banking

EBA publish final ‘Guidelines on Environmental Scenario Analysis’: What European banks need to know about the future of managing ESG risks

19 Dec 25 | Banking

Solvency II Level 2 Review finalised: What insurers should focus on before 2027

17 Dec 25 | Insurance